Once in a lifetime, while making any transaction like NEFT, RTGS, or IMPS, you must have come across the word “IFSC.” Well, IFSC stands for Indian Financial System Code which varies from one bank to another. Usually, this code can be found in your cheque book and comes in handy when making a transaction.

The IFSC code for each bank is decided and assigned by the Reserve Bank of India. Nowadays, you can easily get the IFSC Code for a particular bank online also. However, you need to have some required information to do the same. In this blog, we’ll walk you through every detail related to IFSC as well as the MICR Code. So stay tuned with us till the end to know every bit and bite of it.

What is an IFSC Code?

The eleven-digit IFSC code is a unique code that comprises letters and numbers. It is utilized for NEFT, IMPS, and RTGS transactions to transfer money online. As mentioned above, it can usually be found on the chequebook issued by the respective bank. Also, it is printed on the cover of the accountholder’s passbook.

The Reserve Bank of India designates the IFSC code for each bank branch. Without a valid IFSC or Indian Financial System Code, NEFT, IMPS, and RTGS fund transfer transactions over the internet cannot be made. Generally, there are no updates or changes to the 11-digit IFSC code. However, after merging with five affiliate banks and one additional bank, the State Bank of India recently altered the Indian Financial System Code at all of its branches across the country.

Features and benefits of IFSC Code

Smooth online funds transfer: IFSC codes make transferring money between bank accounts simple and convenient. All electronic or online fund transfers using NEFT, RTGS, or IMPS must be made using an IFSC Code.

Keeping track of transactions: The RBI uses the IFSC number to regularly track all banking transactions, minimizing the likelihood of any discrepancy during the fund transfer procedure.

Unique identification: IFSC code assists in the unique identification of all banks and their corresponding branches, assisting customers in avoiding potential errors.

Elimination of errors: Errors are reduced since customers can transfer funds safely with the use of the IFSC code, which lowers the likelihood of fraud in online funds transfers.

IFSC code format for banks

The first four characters of an IFSC code are letters that stand in for the bank name. As a result, the identical four letters will start the code for each branch of the same bank. Zero makes up the fifth character.

The branch code is indicated by the final six characters, which are either digits or integers. This is what distinguishes an IFSC code from other codes.

What is a MICR Code?

Magnetic Ink Character Recognition (MICR) is a 9-digit code that helps to identify a specific bank branch that is a component of the Electronic Clearing System (ECS), which is used to routinely clear checks. This code is printed on the passbook that is given to the account holder as well as on the cheque leaf that the bank issues.

The first three digits of the nine-digit number are used to specify the city, the following three are used to specify the bank, and the last three are used to specify the bank branch. For instance, “700002021” is Kolkata’s MICR code for the SBI branch. Here, the first three digits (700) are used to describe the city, the next three digits (002) are used to specify the bank, and the final three digits (021) are used to specify the bank branch.

Cheques are generally processed and cleared by machines using the MICR code. The 9-digit number helps to reduce errors in the clearing process, speeds up the procedure, and improves the security and safety of processing checks.

What are the uses of the MICR Code?

Listed below are some of the uses of the MICR Code that you must know:

In order to speed up the processing and clearance of checks and other documents, the banking industry uses a character recognition technique called MICR, or Magnetic Ink Character Recognition Code.

The primary purpose of the code is to verify the validity and originality of paper-based documents used in the banking system, primarily checks.

When it comes to the transfer of funds through NEFT or IMPS, MICR Code is equal to IFSC.

The technique allows bank employees who are MICR readers to scan checks and instantly read the information.

Every bank branch has a distinct MICR code that is provided by the RBI, which aids in identifying the specific bank branch and expedites the clearing process.

Where can the IFSC and MICR found on the chequebook?

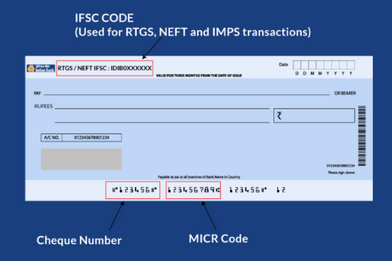

The bank’s issued chequebook contains both the IFSC and MICR Code. The MICR Code is printed on the bottom side of the cheque leaf, whereas the IFSC Code is placed at the top. The first page of the pass book provided by the specific bank branch also has the IFSC and the MICR Code.

How a money transfer is initiated with the IFSC Code?

Online money transfers are now simpler and less complicated all thanks to the IFSC Code. These codes have been given by the RBI to the bank branches so that NEFT, RTGS, and IMPS fund transfers can be done quickly. Let’s use this example to see how IFSC functions while transferring money. The HDFC Saket, New Delhi branch’s IFSC code is HDFC0000043.

The bank, which in this case is HDFC Bank, is identified by the first four digits.

Every time, the fifth digit is “Zero.”

The final six characters, 000043, allow the Reserve Bank of India (RBI) to identify the bank branch.

Let’s now know the IFSC’s role in a transaction. The payee’s IFSC code and bank account number are required when initiating a fund transfer. The money is smoothly transferred to the beneficiary’s account using the IFSC Code once the sender has provided all the required details. When using an IFSC code, a fund transfer just needs a few minutes to complete.

When buying mutual funds or insurance through net banking, IFSC can also be used. IFSC Code enables RBI to maintain track of various transactions and carry out fund transfers without any hassles because the National Clearing Cell of the Reserve Bank of India monitors all activities.

Conclusion

On a concluding note we can say that, IFSC pays a very crucial and important role while making any king of e-transactions. Here, you should note that this IFSC Code is nowhere related to the UPI payments made. So, always remember to keep your IFSC code handy while making any e-payment. Also, make secure transfers and stay safe from phishing and frauds!

FAQ's

The term “IFSC” stands for “Indian Financial System Number” and refers to an 11-character alphanumeric code that is used to permit electronic or online transfers of payments utilizing NEFT, RTGS, or IMPS from one bank account to another.

The MICR Code is made up of 9 digits, but the IFSC Code is an unique combination of 11 characters.

By looking at the first 4 characters of the IFSC Code, consumers can quickly determine the bank name. For instance, the first four characters of the code “ICIC0002634” make it clear that the IFSC code belongs to ICICI Bank.

No, cheque is not needed for making a NEFT payment.